Business Risk Assessment

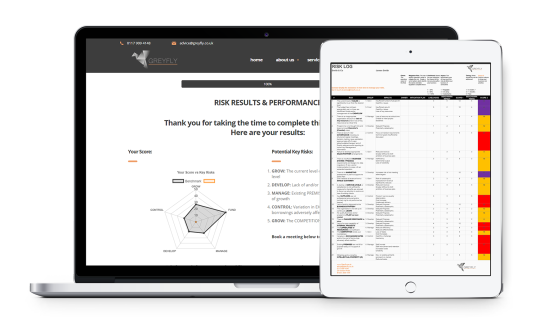

This assessment provides value to founders, directors, and executives of companies looking to grow. It allows you to create a set of prioritised risks in a matter of minutes. These business risks have also been bench marked against other companies. On completion, you will receive a personalised business risk log.

Benefits of conducting a business risk assessment:

OPERATIONAL FOCUS: Risk management will provide you with the insight to identify which tasks your company should be prioritising

REDUCED RISK: While it might sound silly, but if your business understands its risks it will reduce its risk of failure

IMPROVED EFFICIENCY: When risks are mitigated and barriers eliminated this will in turn boost efficiency

Getting your risk assessment is easy – simply click the Start Your Business Risk Assessment button to begin the process.

Great for prioritising your to-do list and outlines the 21 main risks and how susceptible your business is to them

Great for prioritising your todo list and outlines the 21 main risks and how susceptible your business is to them

Business Risk Assessment

This assessment provides value to founders, directors and executives of companies looking to grow. It allows you to create a set of prioritised risks in a matter of minutes. These business risks have also been bench marked against other companies. On completion you will receive a personalised business risk log. If you wish to discuss your key risks further please get in touch with Greyfly.

Benefits of conducting a business risk assessment:

OPERATIONAL FOCUS: Risk management will provide you the insight to identify which tasks your company should be prioritising

REDUCED RISK: While it might sound silly, but if your business understands its risks it will reduce its risk of failure

IMPROVED EFFICIENCY: When risks are mitigated and barriers eliminated this will in turn boost efficiency

Getting your risk assessment is easy – simply click the Start Your Business Risk Assessment button to begin the process.

Managing Business RisksDoing the right things at the right time

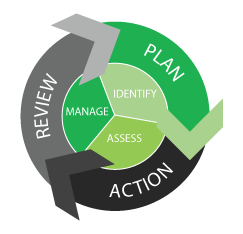

At that time when you are not sure what to do, how to grow, or become more efficient, independent consultancy helps. Here at Greyfly we propose a THREE-STEP APPROACH to managing Business Risk and believe this will accelerate growth.

The Challenge

1) WHAT are the risks?

The IDENTIFY stage concentrates on outlining your risks, making them distinct and comprehensible. Analysing your vision and current operations to identify existing weaknesses before capturing and describing each risk within your initial risk log. This activity can be accelerated by an understanding of common business risks and usage of risk management tools.

2) WHICH risks are important?

The ASSESS stage defines the potential impacts if a risk was to materialise. Risk impacts scaled in terms such as

finance, time and loss of Return on Investment. Then working with a single allocated executive owner, each risk is scored to assess its relative priority.

3) HOW to manage risks?

The MANAGE stage defines the actions and timescales to mitigate each risk occurring. Each mini-project plan is constructed with the owner for wider communication before a wider review process is implemented. Longer-term you should reference historical lessons so these can be applied in the future.

Common Business Risks

Through consultation with our clients, we have found that there are pervasive common business risks. If your company can ensure these are being managed it will go a long way to enabling success.

Common risks that if managed can be used to accelerate your growth include:

1) Lack of Sales means lack of cash!

Sometimes companies need to be reminded that sales are the heart of the business, or at least with insufficient sales we have no funds to invest in the things needed to grow and/or scale.

2)Inefficient Processes and/or Business Systems

To drive efficiency companies should work smart and this often means examining and potentially automating the process using risk management software.

3)Resource Volumes & Capability

AI and automation have not yet taken over so even if we had funds we still need people to do the work and of course, these need to be right people with the right skills for risk management tools.

4) Over dependence on single Suppliers or Customers

Never put all your eggs in one basket – Unfortunately, the world turns so even if things are good at that moment always plan for the future and reduce over-reliance.

5) Get yourself organised

Companies large and small can often lack key meetings and/or have completely ineffectual ones. Meeting input and outputs should follow a chain of turning data into information which is then communicated to enable and improve Executive focus.

Guides for Risk Management

The following sets out a few tips that tell you why your company should manage its risks to help you DO the RIGHT things at the RIGHT time.

• Risks management stops car crashes!

Risk is simply defined as the possibility of suffering harm or loss; and/or exposure to danger. The key here is the word “possibility”, in other words, it has not yet happened. Therefore, if you can prevent risks occurring it can stop the additional effort and potential cost of having to deal with a car crash.

• Common risks affect all businesses

You can control your business risks by accelerating the identification and management of common risks. Of course, respective importance will vary by company and of course companies are likely to find they have their own unique risks.

• Risk management needs executive focus

Establish a culture of risk management by ensuring there is a sufficient focus on risks in all key meetings. This is not a one-off exercise but there should be a process of on-going management.

• Risk management is an important part of success

Pragmatic use of basic risk management techniques can enable executives to do the RIGHT things at the RIGHT time